Strategies for Building Owners in Maryland

August 17, 2023 | By: Matthew Torr

Summary:

- Maryland’s Climate Solutions Now Act presents an urgent need for building owners to plan for compliance and reduce the state’s greenhouse gas emissions.

- Building owners must phase out fossil fuel consumption and adopt energy-efficient HVAC, domestic water, and lighting systems to meet mandated GHG reduction goals by 2030 and achieve net-zero carbon status by 2045.

- Mitigation strategies include energy audits, LEED O+M certifications, decarbonization, rooftop solar or other renewable energy adoption, and embracing financial incentives, ultimately ensuring a sustainable future while avoiding penalties and additional costs.

With so many question marks around what building owners and new development projects will be required to implement, it is tough to fully prepare for the mandates that will follow the Final Plan of the Climate Solutions Now Act (CNSA). However, after careful evaluation of the draft plan, Lorax has identified ways that project teams and existing building owners can mitigate risks and plan ahead for the Climate Solutions Now Act that is expected to be released in December 2023.

First, if you haven’t already, take a few moments to read over our blog on navigating the Climate Solutions Now Act 2022 to become acquainted with milestones and what to expect with this new legislation – there is some valuable information in there that will help you to understand how the law will affect you and your business.

Planning Ahead for the Climate Solutions Now Act

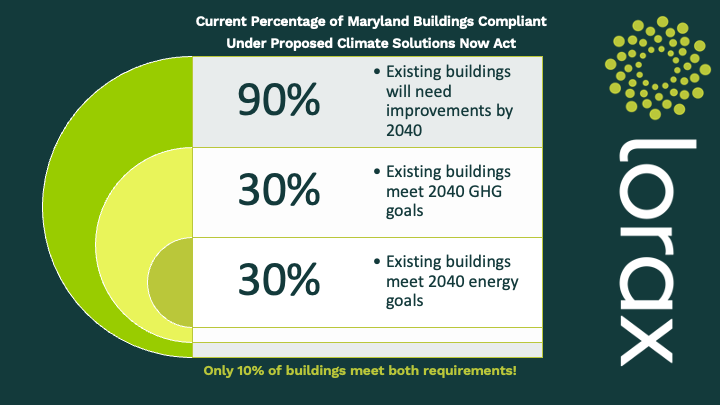

Now, to put things into perspective, buildings account for roughly 40% of the world’s greenhouse gas emissions. In Maryland, our buildings account for about 18% of the state’s GHG emissions and although this number may seem like a small portion of the GHG emission pie, building emissions are the third highest contributor to GHG emissions in the state; falling behind Agriculture and Transportation. To date, only 10% of the state’s existing buildings meet both the 2040 energy and GHG goals established by the Climate Solutions Now Act.

Another way to look at our current progress is to say that 90% of our existing buildings will need improvements by 2040; that is a huge number of buildings that will need to make building upgrades in order to comply with the requirements set forth by the Climate Solutions Now Act!

A Pressing Timeline

Existing buildings and new design teams need to begin considering ways to electrify their projects in order to avoid costly penalties and expensive equipment upgrades before it is too late. Furthermore, project teams making design decisions today that include natural gas or other fossil fuel consumption within the building will need to consider phasing out equipment to avoid penalties. Fossil fuels are incompatible with a net-zero carbon state in 2045.

On a closer timeline, buildings will need to address the mandated 20% reduction in GHG emissions by 2030. To begin reducing GHG emissions and energy consumption, buildings will need to install more efficient HVAC systems, such as electric heat pumps, which also are able to capitalize on other parts of CSNA which are making the electric grid less carbon intensive.

Failure to comply with these reduction goals will result in building owners facing penalties for not electrifying their HVAC system in addition to bearing costs for utility infrastructure installation. As a consideration, designing a building today to use natural gas requires bringing the utility online in the building, i.e., additional labor and material costs. By 2040, when the building will be required to electrify, additional labor and material costs will be borne by the owner to convert the infrastructure to be compatible with the new system; not to mention the additional costs of installing new HVAC equipment.

I didn’t go to school for accounting, but it seems like a no-brainer to avoid these additional costs of material and labor when the decision could have been made to plan for what is ahead.

Risk Mitigation Strategies for the Climate Solutions Now Act 2022

For a moment, let us talk some hypothetical numbers to gain a better understanding of what the implications of non-compliance could mean for a building owner.

First, let’s evaluate the lowest penalty scenario for a hypothetical 250,000 SF distribution center built in Maryland in 2022. Using Energy Star to track actual building performances across the country, we know that an average distribution center has an energy use intensity (EUI) of 22.7 MBH/SF and produces GHG equivalent to 31,105 tons CO2 each year.

In comparison, a baseline using ASHRAE 90.1-2010 has an EUI of 26.1 and GHG of 35,770 tons CO2 equivalent. The 2030 requirement of 20% GHG reduction from the Baseline would result in an EUI of 20.9 and GHG of 28,616 tons CO2 equivalent.

In a lowest penalty scenario, with the carbon cost at the current rate of $51/ton, the building’s estimated GHG Overage is 2,489 tons CO2 per year; resulting in $126,939 per year in penalties, or about $0.50 per square foot.

Now let’s compare the worst-case, highest penalty scenario with the same theoretical building, same EUI and same GHG emissions, but with the baseline determined by the actual 2025 Performance.

We assume the 2025 building performance are roughly what the 2023 national average is for a building of this size and type. The 2030 requirement of 20% GHG Reduction results in a much larger reduction, with an EUI of 18.2 and GHG emissions of 24,884 tons of CO2 equivalent.

As a result, the same building now has an estimated GHG Overage of 6,221 tons CO2 per year. Assuming the 2023 proposed cost of carbon is approved at $200/ton, the same project could face somewhere in the realm of $1,244,200/year in penalties by 2030. Now we’re looking at almost $5 per square foot in yearly penalties. No thank you!

So how can building owners begin to mitigate these risks and effectively plan ahead? Glad you asked…

Energy Audits, and Retrofits, and LEED O+M Certifications, Oh My!

In order to make actionable and calculated decisions, understanding performance is a must. Existing buildings can begin to understand their consumption habits by performing an ASHRAE certified energy audit. An energy audit provides an in-depth look at the buildings systems, usage, lighting, plug-load, etc. as a means to analyze a building’s performance. Additionally, existing buildings can implement lighting and equipment retrofits that will help the building to run more efficiently.

While these approaches are certainly valuable as standalone approaches, they are also requirements for new LEED

O+M certifications. Depending on your location in Maryland, buildings that earn LEED O+M Silver certification or higher are eligible for annual tax rebates in the tens of thousands of dollars; so why not get a little reward for helping to improve your building’s operations?

Decarbonization

Maryland has a relatively clean electric grid, and the Climate Solutions Now Act will make it even cleaner. Currently under consideration in the

CSNA draft is a new policy to mandate zero-emission space heating and water heating equipment. To do so, new projects will need to implement all-electric systems to meet this policy.

Statewide consumption of natural gas is projected to decrease, while the cost of maintaining gas infrastructure will remain mostly constant. Invariably, the cost per unit to buy natural gas will increase, making this formerly inexpensive fuel type become a costly approach.

Rooftop Solar

It is no doubt that solar arrays are popping up more and more these days. Harnessing the sun’s energy throughout the day is a passive way for buildings to offset energy consumption through the grid and there is A LOT of rooftop real estate on the many commercial buildings throughout the state. Many existing buildings can take advantage of the many state and federal incentives to install solar panels on their building in a cost-conscious way.

Projects that are being designed today should always consider implementing solar arrays on their roof. Project teams should begin asking the question, “Why aren’t we implementing solar into the design?”

Additional Strategies

Change does not come overnight, but placing clear guidelines and plans in place helps to push initiatives from being hypothetical ideas and into reality. New construction projects have a great opportunity to set the bar high with stringent sustainability stands and energy performance plans. The sooner teams are receptive to making these changes the norm, the easier it will be to implement these strategies on every project. Sure, the codes or standards may not require you to do these things now but why wait till the last minute to adopt what others have already been doing?

The only thing this does for you is provide you with less experience in a consistently competitive industry – be a leader and invoke the change as a way to set your firm or building part.

Finally, we cannot forget to mention that there is an astronomical amount of financial incentives available to new projects and existing buildings alike. Taking advantage of Federal and State tax incentives, rebates, and tax credits allows you to do good for the environment while being rewarded financially for doing so. (Thank you, Uncle Sam!)

If you have made it this far, you are bound to have questions that require additional information to fully take advantage of and understand what lies ahead for Maryland with the Climate Solutions Now Act. Lorax is here to be a resource and provide you with the necessary knowledge to make informed and logical decisions. Our consultants welcome a discussion to educate you further on what’s ahead and how you can prepare for the Climate Solutions Now Act in Maryland.

Contact Casey Ross for all energy related questions, Matt Torr for LEED O+M inquiries, and Tim Barranco for a comprehensive understanding of incentives, tax credits, and rebates!

Together, we can develop sustainable buildings for a healthy environment.