At Lorax, we find, the largest barrier to adopting renewable energy systems for private property owners is the lack of financing options. Slowly but surely, counties in Maryland are adopting the Property Assessed Clean Energy (PACE) financing method to make renewable energy a more feasible option. Here’s how Tim explains the program:

The PACE program is a government financing policy. Its goal is to incentivize energy efficiency and renewable energy upgrades on private property. It allows private lenders to fund the up-front capital cost of these upgrades, and recoup that money via property taxes. The payback period will be based on the life expectancy of the equipment- for solar panels it may be 20 years, for an HVAC system maybe 15 years. The interest rate on the loan will be in the ballpark of 5%.

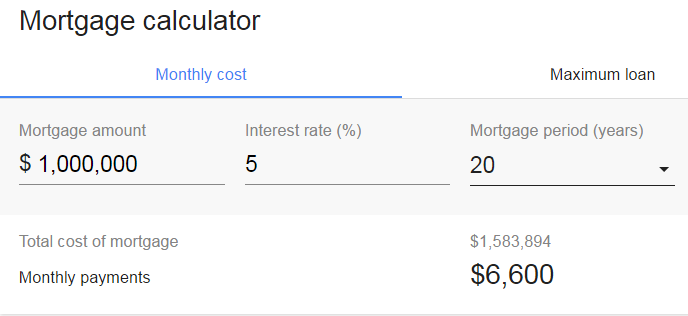

Here’s an example of a project considering installation of a $1,200,000 solar PV array, rated at 700 kWp. Let’s assume the property owner secures $200,000 in incentives and rebates for their solar array. Through PACE, a lender would cover the remaining $1,000,000; the owner would pay it back like a 20-year mortgage at 5% interest.

Their property tax bill would have a line item for the PACE-funded solar panels. In this example, they’d owe $79,200 annually.

Using some assumptions about solar panel output, we can estimate that the 700 kWp solar array will produce about 600,000 kWh of electricity annually. At rates of around $0.20 per kWh, that amounts to $120,000 in energy cost savings annually, more than the loan repayment amount. In this case, the owner would see an immediate positive impact on their net operating income. The 3, 5, or 7-year payback period people often discuss with these kinds of upgrades goes to 0. Of course, this is an idealistic scenario. Real projects will have many more nuances to consider, but this should give you feeling for the kind of cost-benefit analysis that PACE presents.

The PACE program has been running in California since 2010. Now in 2016, it’s active in 16 states. Maryland has adopted it, but each County must decide whether to opt in or not participate. So far, Anne Arundel, Howard, Montgomery, Queen Anne’s, and Garrett County are in. Many others are in the process of adopting or evaluating the program.

In Maryland, it’s available for commercial, industrial, and multifamily projects. It’s available for new construction and retrofits/rehabs. Government-owned projects and single family residential do not qualify at this time. Residential is eligible in California, and Maryland is going through a 2-year study to evaluate it.

Energy upgrades must exceed code requirements to qualify. Water efficiency upgrades can also qualify. Solar panels and geothermal HVAC systems are popular choices.

PACE covers both equipment and installation costs- everything a contractor would charge to complete the project. PACE financing cannot exceed 35% of the property value.

If an owner of a property uses PACE financing and subsequently sells the property before the loan has been repaid, the PACE tax assessments transfer with the property to the new owner.

If you are pursuing PACE financing, your project plan will be reviewed by a PACE lender and by the PACE program administrators. It will undergo a 3rd party technical review to verify that the energy savings claimed are substantiated. If there is an existing mortgage on the property, the mortgage lender will need to give consent as well. Once through those hurdles, the money will be released and you can begin construction.