Maximizing Federal 179D Rebates

June 23, 2023 | By: Casey Ross

Summary:

- The Inflation Reduction Act (IRA) brings significant changes to sustainable energy reduction strategies in buildings.

- The primary change is the transformation of Federal 179D rebates from tax rebates to tax incentives, benefiting commercial building owners.

- The incentives range from $0.61 to $5 per square foot, depending on the energy reduction achieved and prevailing wage usage.

- Lorax Partnerships provides rebate and utility assistance to help building owners capitalize on this opportunity.

The Inflation Reduction Act (IRA), narrowly passed last year, will fundamentally change the dynamic of sustainable energy reduction strategies in buildings. The bill has many parts to it, affecting sustainability throughout our country. Discover how the Inflation Reduction Act (IRA) impacts sustainable energy reduction strategies in buildings, specifically focusing on the changes brought by Federal 179D rebates for commercial building owners.

The primary change from this act is through Federal 179D rebates. This rebate has been in existence for many years, allowing building owners to recoup energy savings investments made to their buildings. While the spirit of 179D remains the same, the implementation has changed dramatically in the favor of building owners. So what are the changes and how can you unlock the benefits of this historic opportunity?

From Rebate to Incentive

Previously, tax-exempt institutions used to be left out in the cold. That is no longer the case as Federal 179D has changed from a tax rebate to a tax incentive. This means that the money can now come directly to the owner with an application and doesn’t depend on distribution through tax reductions. Big institutions (schools, governmental buildings, airports, etc.) can now finally get the incentives needed to make energy efficiency projects viable. Another major change is that consultants are now able to help with the process as well, with the incentive distributions being paid directly to architects, engineers, contractors, environmental consultants, and energy service providers.

Some incentives are cheap and easy. Simple in-kind improvements to lighting, envelop, and MEP systems have a low threshold for proven energy savings and garner a smaller incentive at $0.61 per square foot. The fully qualifying incentive is much more difficult, but with incredible potential. It involves a whole-building energy analysis to show a challenging 50% energy reduction over a reference case, which for many will be ASHRAE 90.1-2019 standards. Meeting that goal is highly rewarding, with a $1.82 per square foot incentive.

Is the project in a union market and can prove prevailing wages were used? Congratulations, that incentive nearly triples to $5 per square foot!

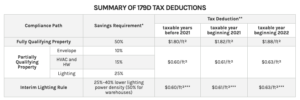

A summary of 179D Tax Deductions for various compliance paths. (Source: https://www.energy.gov/eere/buildings/179d-commercial-buildings-energy-efficiency-tax-deduction)

The Brass Tacks

So how much money is out there? There is no maximum cap on incentive funding. The incentives are limited only by the appetite of the construction community and our ability to build better buildings. A recent analysis by Goldman Sachs places the estimated incentive payout to be in the range of $1.2 trillion, making this piece of legislation significantly larger than the Affordable Care Act (ACA).

This is where Lorax Partnerships connects. Our energy services division, led by Casey Ross, P.E., is excited to offer rebate and utility assistance to building owners and capitalize on this historic opportunity. We are here to help teams unlock the benefits of building sustainability through the Inflation Reduction Act; there is money on the table for those doing the right thing and building wisely.